Owners of Toyota Tacoma pickup trucks frequently purchase auto insurance policies that are referred to as Toyota Tacoma insurance. Similar to other cars the value of the vehicle and the driver’s characteristics all affect insurance coverage. Insurance costs for the Tacoma may be different from those for sedans or small cars. it is a midsize pickup with both personal and light-duty commercial use.

Liability to extra add-on coverages is a common feature of Toyota Tacoma auto insurance. The cost of insurance for models varies based on usage habits and model year.

This information on Toyota motor insurance benefits provides a comprehensive explanation of how manufacturer-backed policies operate, which is another important aspect of understanding Tacoma insurance.

What Is Covered by Toyota Tacoma Insurance

The majority of Toyota Tacoma insurance plans offer:

- Liability protection for property damage and bodily harm

- Collision insurance for damage caused by accidents

- All-inclusive protection against vandalism, weather, and theft

- Payments for medical care or protection against personal injury

- Underinsured or uninsured auto insurance

The typical insurance cost for Toyota Tacoma owners is influenced by these factors taken together.

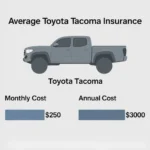

Average Insurance Cost for Toyota Tacoma

When compared to other pickup trucks then the rates are typically in the middle. Drivers can usually expect yearly premiums that result in a consistent monthly cost. The region to engine and trim level all affect how much insurance a Tacoma typically costs.

The typical cost of insurance in the United States is frequently impacted by the vehicle’s popularity and resale value. Rates reflect replacement and repair costs because Tacoma models hold their value well.

These advantages of Toyota auto insurance help explain why Toyota owners frequently select brand-specific policies. Many drivers also take coverage features into account.

Monthly Cost of Toyota Tacoma Insurance

When the monthly cost of insurance is broken down then it often makes budgeting easier. Monthly insurance premiums could change because of:

- Driving background

- Insurance score based on credit

- Mileage and location

- Deductibles for policies

Knowing monthly averages makes it easier to understand how much insurance costs for a Tacoma over time.

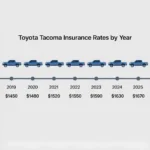

Toyota Tacoma Insurance Rates by Model Year

Insurance rates vary greatly based on the year of manufacture. More advanced features and higher vehicle prices are reflected in newer models.

2005 Cost

Compared to more recent models the insurance for a 2005 Tacoma is typically less expensive. Moderate premiums are supported by a lower market value.

Rates for 2013 Tacoma Insurance

Insurance prices for 2013 are typically moderate. This model year affects the typical insurance rates for Toyota Tacoma customers by striking a balance.

Insurance for a 2016 Tacoma

The 2016 insurance price reflects new safety features and appearance. Rates are consistent but higher than those of previous generations.

Rates for 2017

Because of the electronics and safety systems, insurance prices often include increased maintenance costs.

Rates for 2018

The 2018 rates offer stable insurance costs and are in accordance with mid-generation pricing.

Cost of 2019

Due to increased resale values and new technology, the cost of 2019 Tacoma insurance is trending slightly upward.

Cost of 2020

The price of 2020 models accounts for increased component costs and enhanced safety measures.

Cost of 2021 Insurance

Advanced driver-assistance technologies have the potential to reduce accident rates while simultaneously increasing maintenance costs, which has an impact on the 2021 insurance costs.

2022 Insurance Cost

Changes in vehicle prices and market inflation typically cause increases in 2022.

2023 Cost

The 2023 Tacoma cost reflects high demand and supply-related repair expenses.

Cost of 2024

The 2024 Toyota insurance costs are commensurate with improvements and rising auto replacement costs.

2025 Insurance Cost

In the midsize truck segment, insurance rates are expected to remain competitive in 2025, taking into account inflation and technological advancements.

📊 Toyota Tacoma Insurance Cost by Model Year

| Model Year | Average Annual Insurance Cost | Average Monthly Cost | Insurance Cost Trend |

|---|---|---|---|

| 2019 Toyota Tacoma | $1,420 | $118 | Moderate |

| 2020 | $1,460 | $122 | Moderate–High |

| 2021 | $126 | High | |

| 2022 | $1,580 | $132 | High |

| 2023 | $1,620 | $135 | High |

| 2024 | $1,680 | $140 | Higher |

| 2025 | $1,720 | $143 | Highest |

Reference Source:

Toyota insurance cost trends and safety-related pricing factors are based on vehicle data and safety insights from Toyota’s official resources:

👉 https://www.forbes.com/advisor/car-insurance/

Why Does Tacoma Insurance Cost So Much?

Many drivers wonder why Tacoma insurance is so costly. Among the primary causes are:

- Increased prices for parts and repairs

- High resale value

- Higher probability of off-road or utility use

- Statistics on the severity of pickup truck accidents

These elements contribute to the explanation of why insurance prices could seem higher in some areas.

When compared to other trucks

The prices are higher than those of compact cars but competitive with those of comparable trucks. The average insurance costs for models often fall below those of full-size pickups.

California Insurance

Insurance for Toyota Tacomas in California is frequently higher than the national average. This is because of:

- Increased density of traffic

- Labor costs for repairs

- State laws related to insurance

In comparison to rural states, drivers in California should expect somewhat higher insurance rates.

How Much Does Toyota Tacoma Insurance Cost? Important Elements

When determining the cost of insurance, take into account the following factors:

- Age and record of the driver

- Year and trim of the vehicle

- Mileage and location

- Limits on coverage and deductibles

The cost of insurance for models is directly impacted by these factors.

Vehicle value and loan balance can also affect insurance decisions, which is why understanding Toyota GAP insurance in 2025 is important for newer models.

How Insurance Quotes for Tacomas Are Determined

Risk models and actuarial data are used to produce a quote. Insurance companies analyze the frequency of accidents, repair costs, theft rates, and past claims about Tacoma models.

Toyota’s official safety materials are available at https://www.toyota.com/safety-sense/ for general car safety and insurance insights.

National Average vs. Average of Tacoma Insurance

Although it is still less expensive than many full-size trucks, the average insurance cost for Tacoma cars is usually marginally more than the national average. The Tacoma is a reliable option for drivers looking for regular insurance costs because of this balance.

FAQs

Is insurance for Toyota Tacomas costly?

Although more costly than small cars, Tacomas are reasonably priced to insure when compared to comparable pickup trucks.

How much does insurance typically cost?

The typical cost of insurance for a Tacoma varies depending on the driver’s profile and model year.

What makes insurance for Tacoma so costly in some states?

Insurance prices may increase due to state laws and repair expenses.

What is the monthly cost of insurance?

The amount of coverage and individual driving conditions determine the monthly cost.

Do insurance premiums change depending on the model year?

Yes, because of their greater values and repair expenses so in this way newer models usually have higher insurance rates.

Conclusion

It is necessary to consider model year and individual risk factors to determine the cost of Toyota Tacoma insurance. In the pickup market the insurance prices are competitive even though they may be higher than those for smaller cars. Drivers can more accurately predict insurance costs through 2025 and beyond by examining average insurance costs for Tacoma models and taking long-term ownership considerations into account.